Now that you’re prequalified, follow the steps below to submit your SBA 7(a) loan application.

Remember, to qualify for an SBA 7(a) small business loan, your business will need to be:

- In operation for at least 1 year as a for-profit business

- US-based location and operations

- Owner supported / owner funded

- Eligible per the SBA’s requirements

- Loan size determined by average annual revenue of the business and FICO score

- Minimum SBA SBSS score of 155

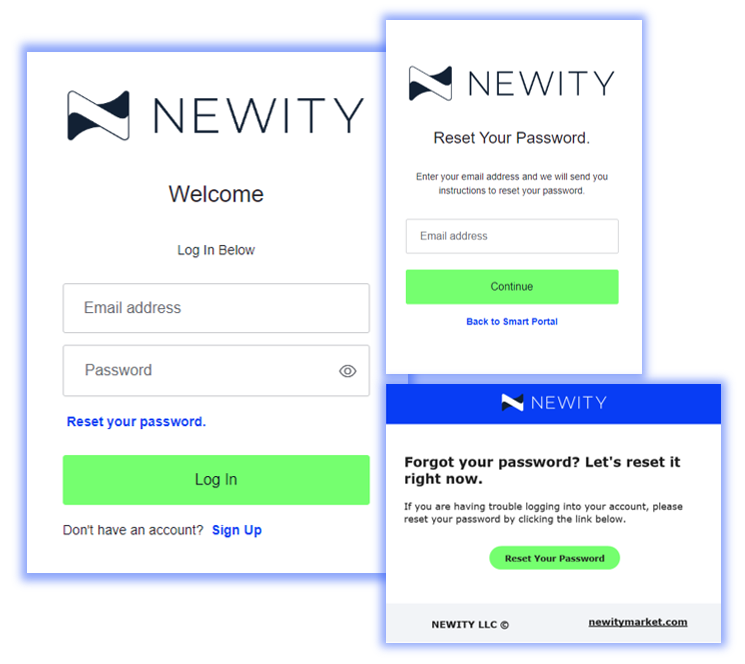

1. Visit NEWITY’s Smart Portal

Visit https://portal.newitycares.com to log in to your account.

View our Account Setup Guide here if you need any additional guidance.

Forgot your password?

No problem, click Reset your password. on the login screen and an email will be sent for you to reset your password.

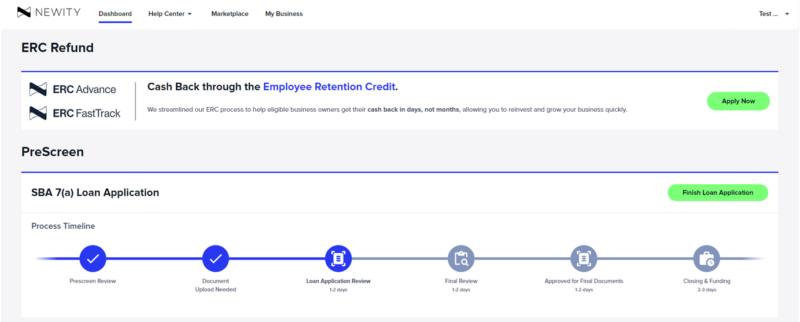

2. Navitage to Your Application within the Smart Portal

When prompted by your relationship manager, navigate to the dashboard within the Smart Portal and click the Finish Loan Application button.

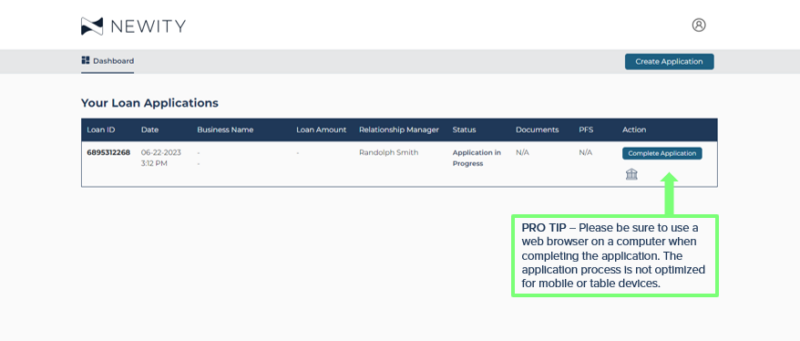

3. Finish Your Application

Click on the Complete Application button to enter the application and either begin or pick up where you left off. This will allow you to complete Form 1919 and will be used as the final review for your 7(a) application.

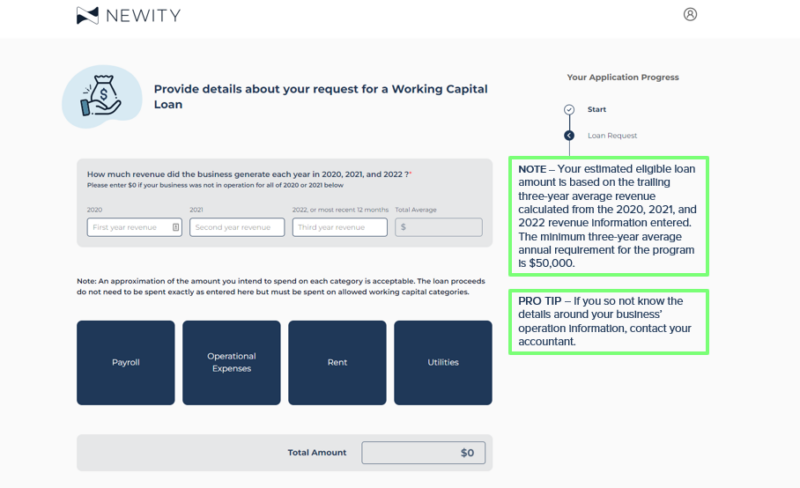

4. Loan Request

Please enter your revenue information as it appears on your business’ tax records for 2020, 2021, and 2022. Depending on your business’ legal structure, this will be Line 1 for Schedule C, Line 2 for Schedule F, or Line 1a for Form 1065, Form 1120, or Form 1120-S.

Please Note: If your company has 2021 and 2022, or only 2022, enter $0 for the years you were not in business.

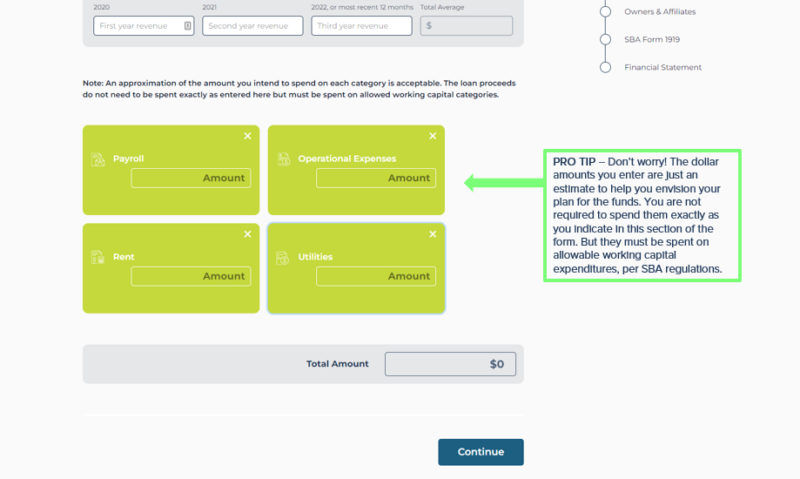

5. Use of Loan Proceeds

In this section, you can indicate how you intend to use the funds from this loan. Simply click the expense category tiles to enter an estimate of how much of the loan proceeds you plan to spend on each category.

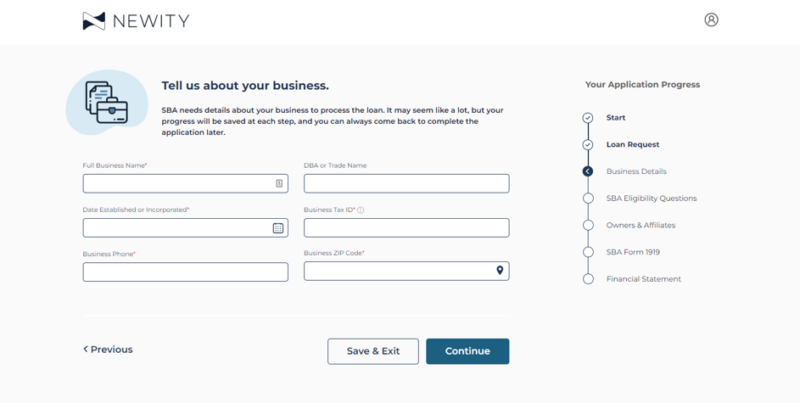

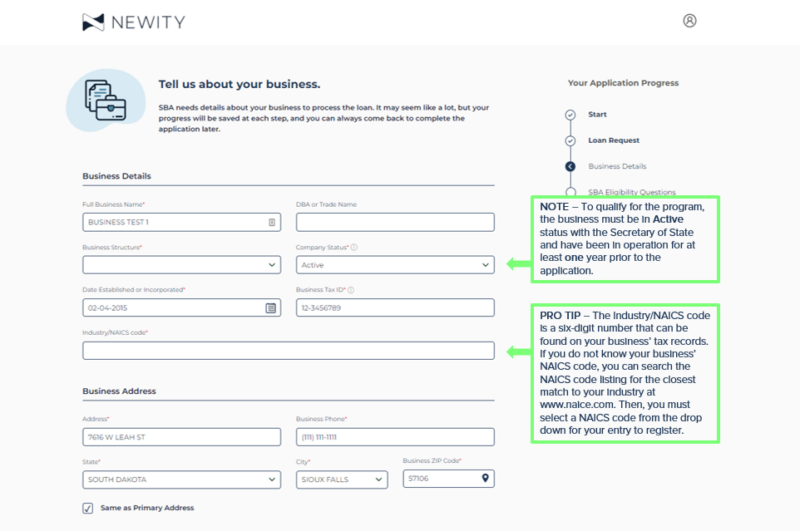

6. Business Details

In this section of the application, enter your business information as it appears on your business’ tax records.

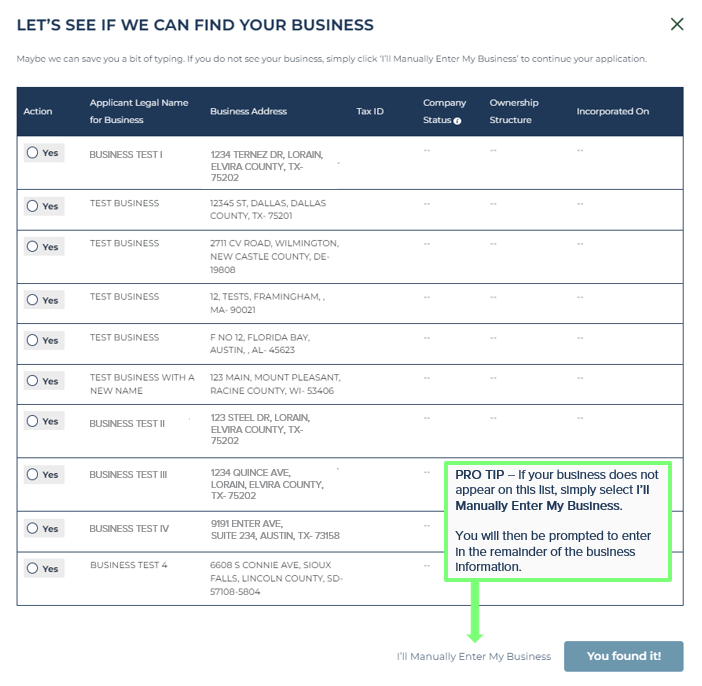

Once you select Continue, our system will perform a Business Look-Up. If your business is found in public listings, certain fields such as the business address, will automatically populate for you. If your business is not found in public listings, you will be prompted to manually enter your business information.

Please take a moment to confirm that your business information is represented correctly throughout the form.

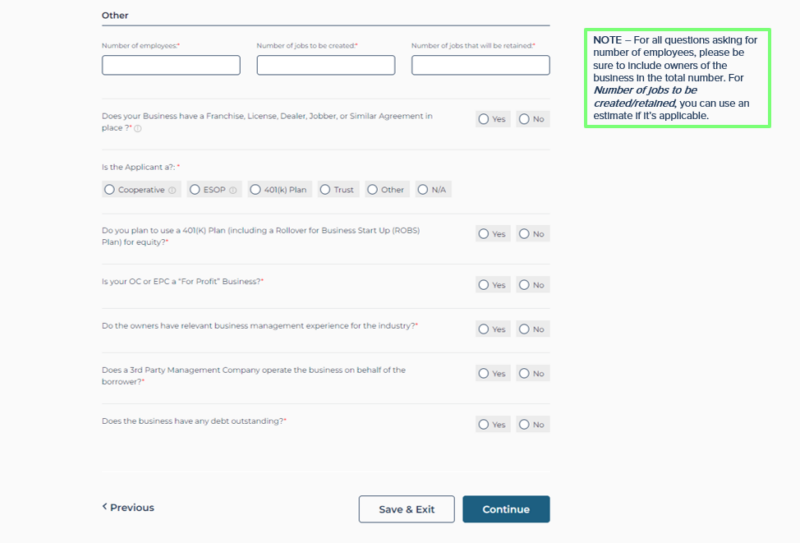

Next, simply follow the prompts to enter the operating information for your business.

Eligibility Check-in:

SBA eligibility requires a business to be an Operating Company or Eligible Passive Company; a for-profit entity; the owners to have relevant business management experience for the industry; and no third party management company can operate the business on behalf of the borrower to qualify. These certifications will be reviewed by our loan specialists during the underwriting phase.

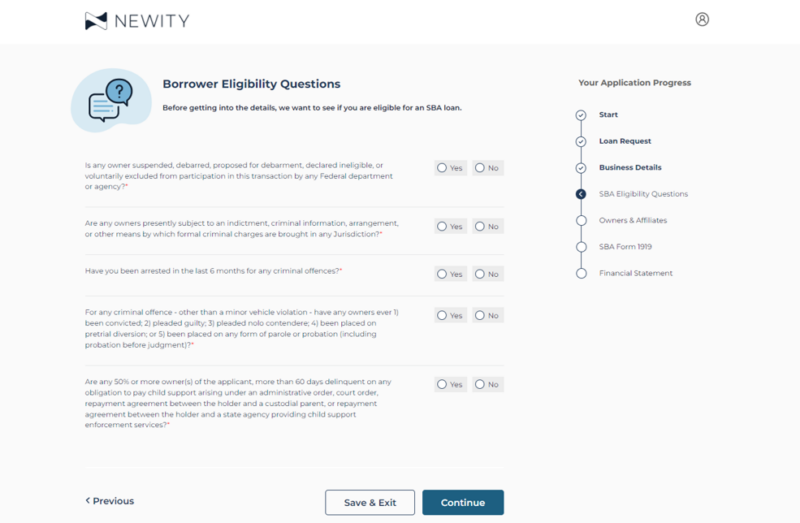

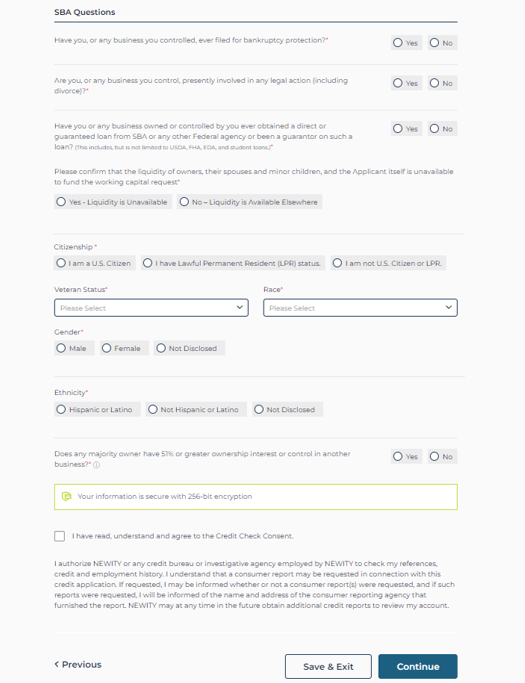

7. SBA Eligibility Questions

Please be sure to completely read each question and answer to the best of your ability. If the answer to any of the questions in this section is Yes, unfortunately, your business is not eligible for SBA financing.

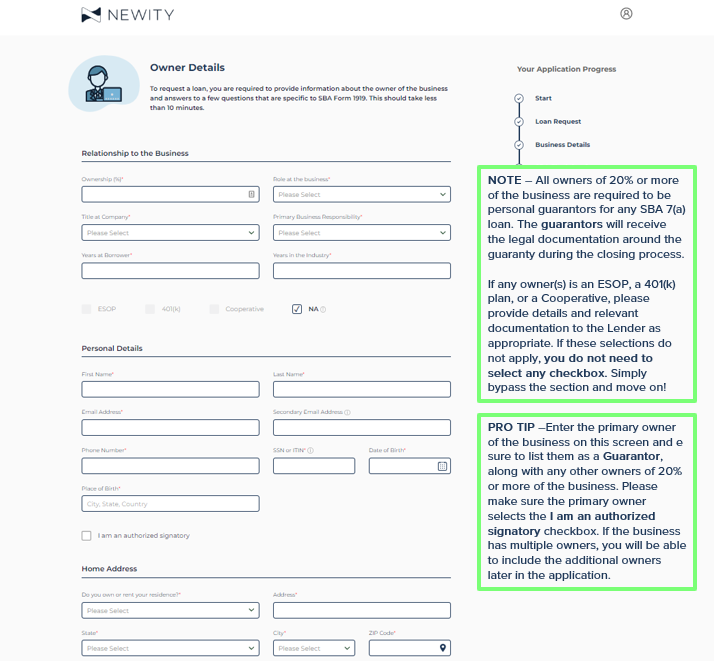

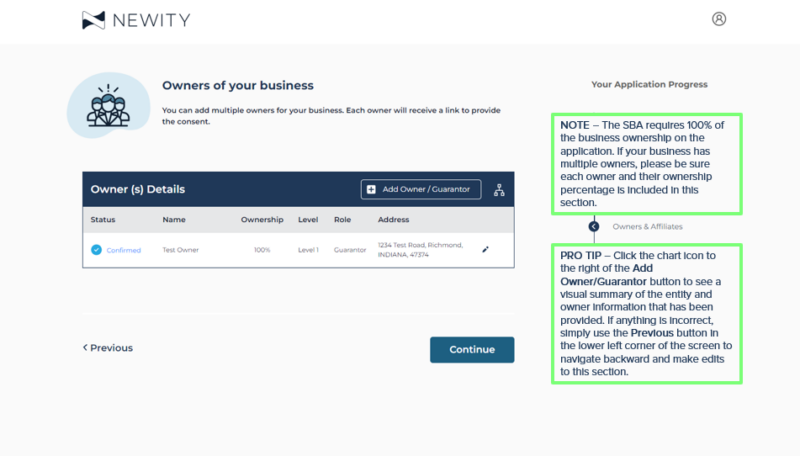

8. Owners and Affiliates

Please provide ownership information for each owner of the business. The SBA requires 100% of ownership to be disclosed, so you will need to enter information for each owner in this section.

(This is uncommon) Any Applicant owned in part, or in whole, by an ESOP or 401(k) plan must also provide to the Lender evidence that the Applicant, ESOP or the 401(k) plan is in compliance with all applicable IRS, Treasury, and Department of Labor requirements and it will comply with all relevant operating and reporting requirements.

You will be able to attach the management agreement, if applicable, in the document upload section at the end of the application.

Be sure to completely read each question and answer to the best of your ability, as incorrect answers could affect your eligibility.

Eligibility Check-in: For SBA loan eligibility, we are required to confirm that your business does not have sufficient cash on hand or other liquidity to finance the loan request.

If you do not have access to liquidity elsewhere, simply select Yes – Liquidity is Unavailable to move forward. Examples of available liquidity that may impact eligibility includes high personal net worth, easy access to traditional bank financing, or large cash balances on the business’ balance sheet.

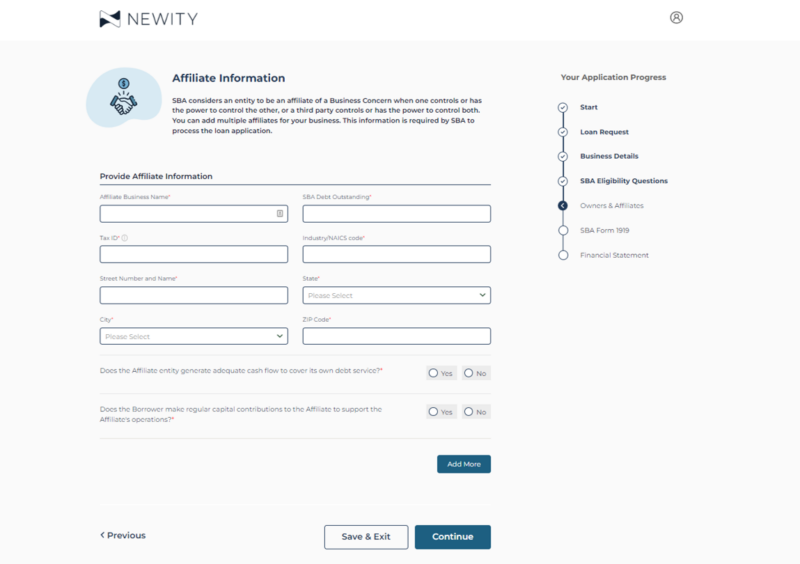

Affiliates:

If any guarantors (i.e., owners of 20% or more of the applicant business) hold 50% or more ownership of any other business, please select Yes to the affiliates question. You will be able to input the affiliate business’ information and answer simple questions about the capital requirements of that business on the next screen.

To learn more about the SBA’s affiliation rules, please click here.

If you indicate Yes to having affiliates, the next screen will be the Affiliate Information section.

Please enter your business information here as it appears on your affiliate business’ tax records and answer the few simple questions about the capital requirements of that business.

Once you have added all business owners, you will see a summary of the ownership information that has been provided.

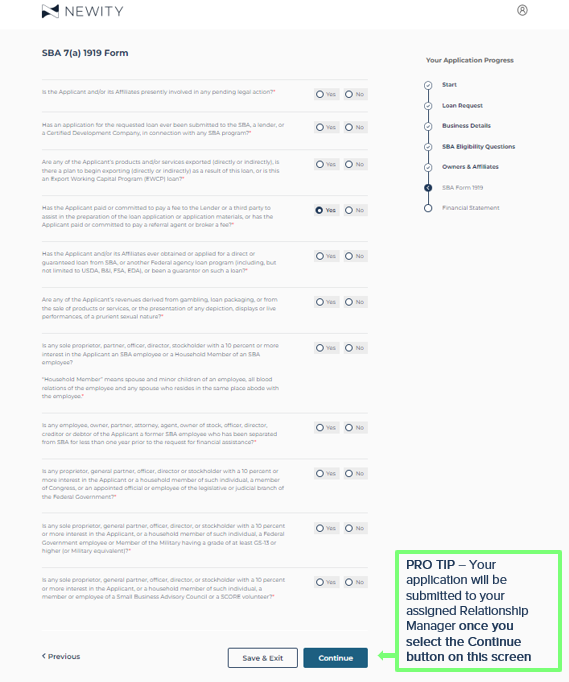

9. SBA Form 1919

This is the last required step of the 7(a) Loan Application! The questions presented in this section are directly from Section I: Business Information on SBA Form 1919. This is a required section that must be collected for all 7(a) loan applications.

Don’t worry; our system will create this form for you! You will just need to answer the listed questions. Be sure to carefully read each question and answer to the best of your ability, as incorrect answers could affect your eligibility or create delays in processing.

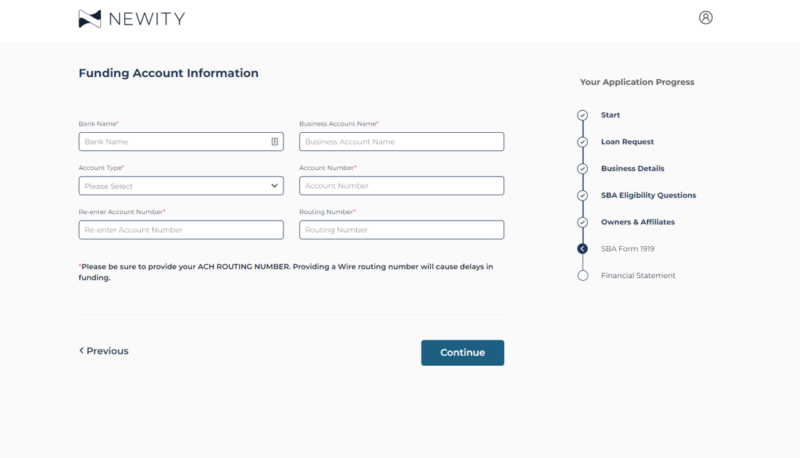

10. Confirm Fund Deposit Account

In this section, you will be prompted to provide the funding account information. Please be careful to provide your Account Number and Routing Number accurately, as this is the information that will be used to fund your loan if it is approved! If you are not sure of either number, we recommend contacting your bank or logging into your online banking account, which will typically list these numbers in the Information & Documents or similar section.

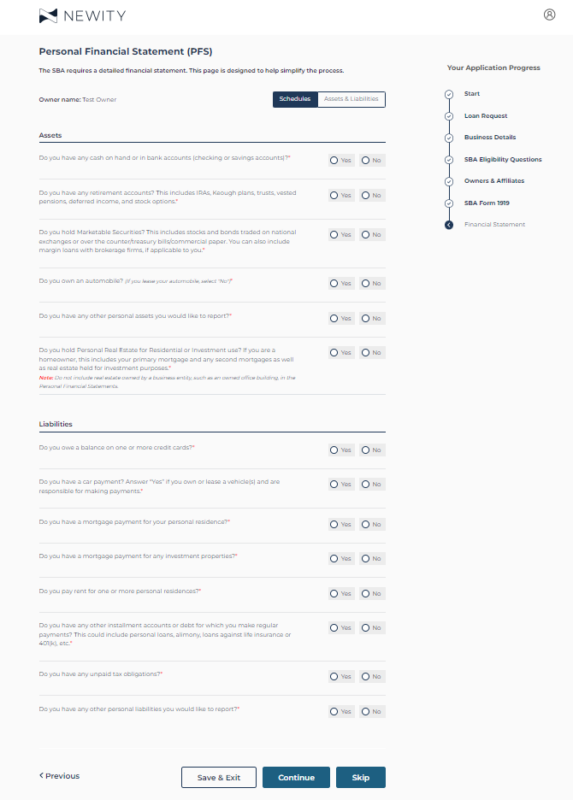

11. Personal Financial Statement (PFS)

Please submit Personal Financial Statements for each guarantor listed on the application. Utilize the simple question and answer format to build your personal financial statements for you. Please note, Personal Financial Statements are required by the SBA before your loan can be funded and we require this information to begin our final review of the application.

Please visit NEWITY’s Personal Financial Statement page to watch a step-by-step video tutorial to complete the Personal Financial Statement section.

12. Confirmation

Your 7(a) Loan Application has been submitted successfully to the Relationship Manager!

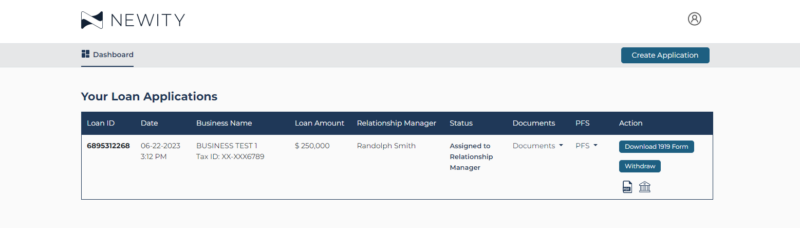

13. Your 7(a) Portal Dashboard

You will see that your loan has been assigned to a Relationship Manager. Please continue to be on the lookout for emails from our team regarding status updates or any additional documentation required.

Note: Email communication from our team will come from an @newitymarket.com email address. You will be assigned live team members who will assist you through every step of the application review and closing process. We look forward to working with you!

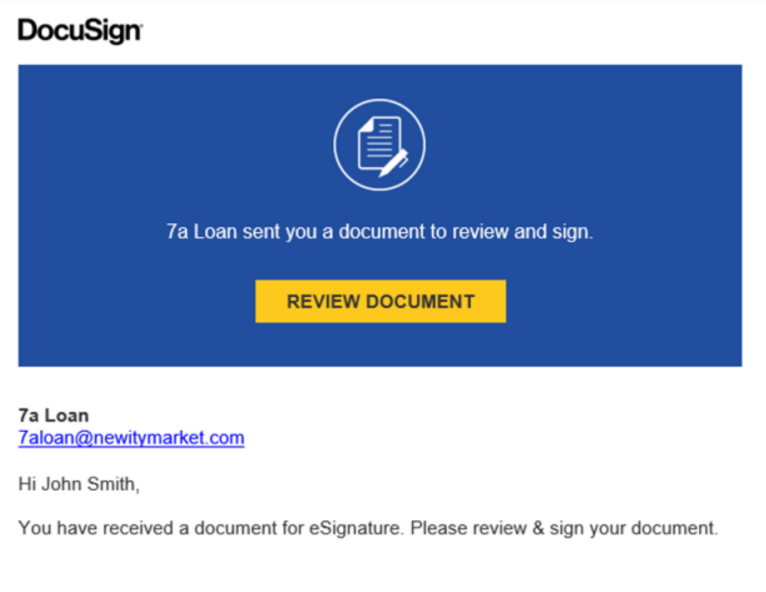

At a later point in the review process, you will be sent your SBA Form 1919 Borrower Information document for execution via DocuSign. Please check your inbox and spam/junk folder for an email from: DocuSign System <dse@docusign.net>. The subject of the email will be E-sign SBA Form 1919.

Note: All other email communication will come from an @newitymarket.com email address.